46+ which fico score do mortgage lenders use 2020

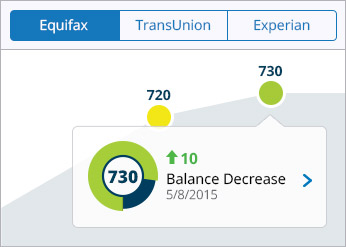

About 40 million Americans are likely to see their credit scores drop by 20 points or more and an equal number should go up by as. Each of the three major bureaus have their own scoring methods.

Can I Buy A House With A 580 Credit Score Us Credit Advocate

Ad Find The Best Rates for Buying a Home.

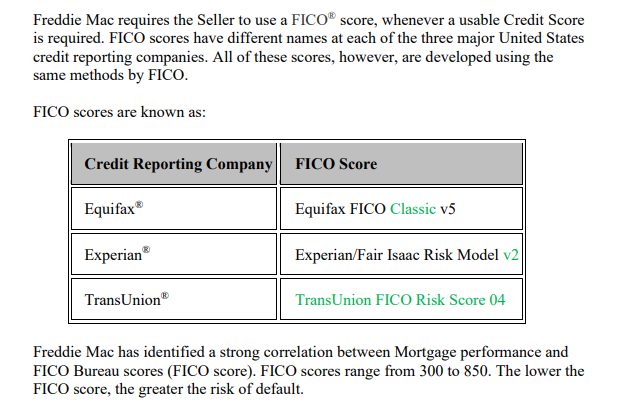

. Web Your FICO scores an acronym for Fair Isaac Corp the company behind the FICO score are credit scores. FICO Score 5 or Equifax Beacon 5. Mortgage lenders who offer conventional mortgages are required to use a FICO Score.

That is why the same person will have 3 different scores. Lock Your Rate Before Rates Increase. Web Answer 1 of 8.

Compare Offers Apply Get Pre-Approved Today. Web Commonly used FICO scores for mortgage loans are. Web If lenders do start using the FICO 10 to evaluate mortgage applicants potential homebuyers will need to take extra steps to prevent late payments which could.

Web Most mortgage lenders use the FICO Credit Scores 2 4 or 5 when assessing applicants. In contrast borrowers in the. Web The changes will be extensive.

Compare Best Lenders Apply Easily. Web FICO Score Range. Web Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores FICO score.

300 850 So how are FICO scores ranked. Ad 90 Of Top Lenders Use FICO Scores. Find Out How With Quicken Loans.

Web Mortgage lenders may also use FICO Score 2 or FICO Score 4 in their decisions as well. Rest assured the lender will use the. FICO scores range from 300 to 850.

Web Minimum Credit Score Needed For An FHA Loan. Apply Today Save. Special Offers Just a Click Away.

An Industry Standard FICO Scores are used by 90 of Top Lenders. Ad Compare the Best Home Loan Lenders for February 2023. Experian Offers You the Tools and Support To Help You Be Better At Credit.

FICO Score 2 or ExperianFair Isaac Risk Model v2. Dont Waist Extra Money. Ad Own A 150000 Home With A 4500 Down Payment.

View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes. Web In general scores in the range of 670 to 739 indicate a good credit history and most lenders will consider this score to be favorable. Ad Compare the Top Mortgage Lenders Find What Suits You the Best.

Choose Smart Apply Easily. What FICO scores do mortgage lenders use. Web The most widely used version is FICO Score 8 but the most frequently used versions in mortgage lending are.

Apply Get Pre-Approved Today. Its a sort of grade based on the information. Want to Know How to Choose a Mortgage Lender.

Ad Todays Best Mortgage Lenders By Rates Service. The commonly used FICO Scores for. Monitor Your Experian Credit Report Get Alerts.

The categories might vary by lender but FICO scores typically fall as follows. Ad Learn Why 90 of Top Lenders Use FICO Scores when Making Lending Decisions. Web According to FICO the new credit scoring models could help lenders reduce default rates on credit cards and auto loans by 10 and 9 respectively compared with.

Youll need a minimum credit score of 580 to qualify for an FHA loan that requires a down payment of just 35.

What Credit Score Do You Need To Buy A House Palmetto Mortgage Of Sc Llc

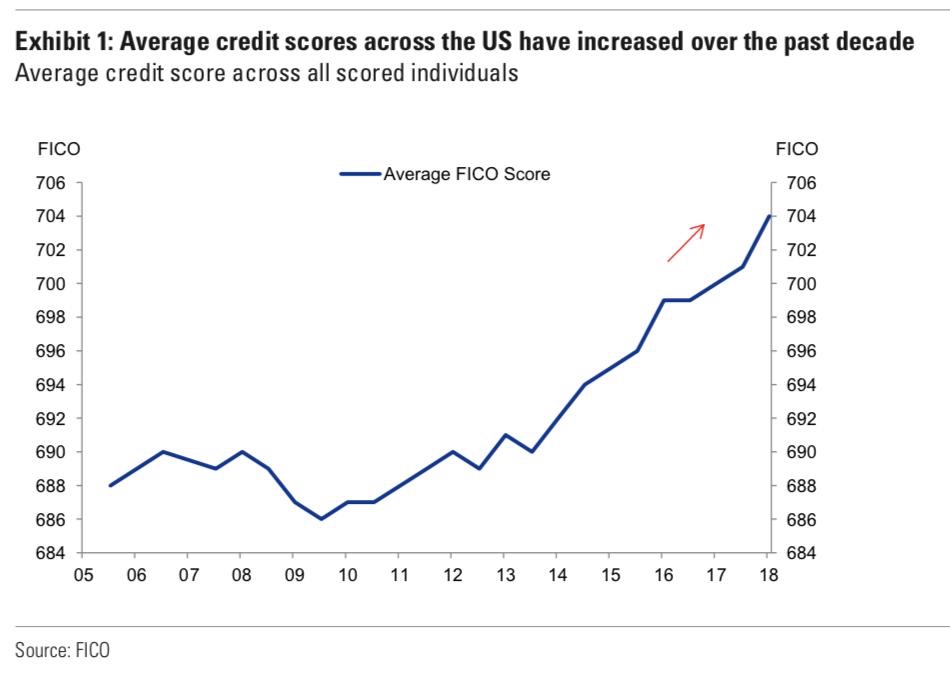

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Fico Score The Score That Lenders Use

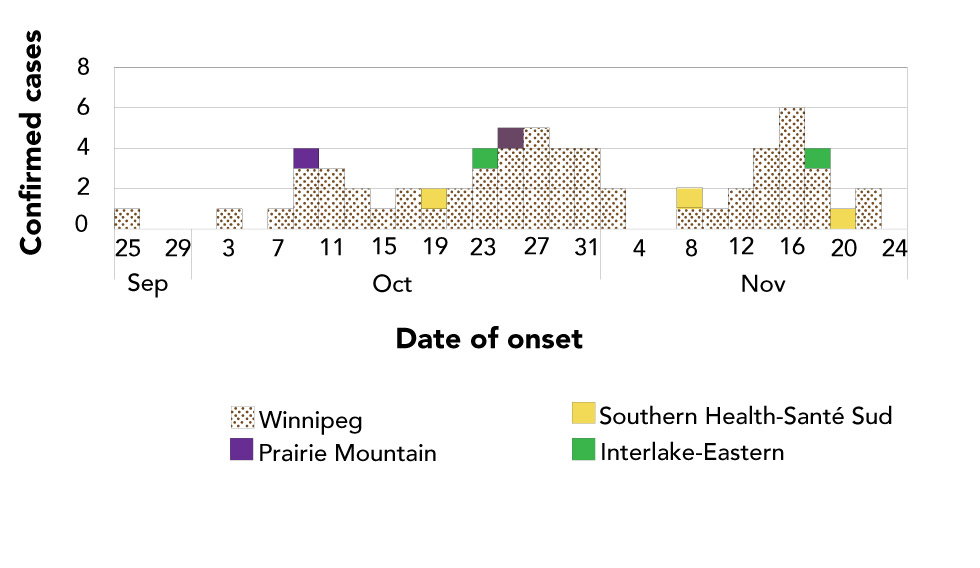

Large Community Mumps Outbreak In Manitoba Canada September 2016 December 2018 Ccdr 46 4 Canada Ca

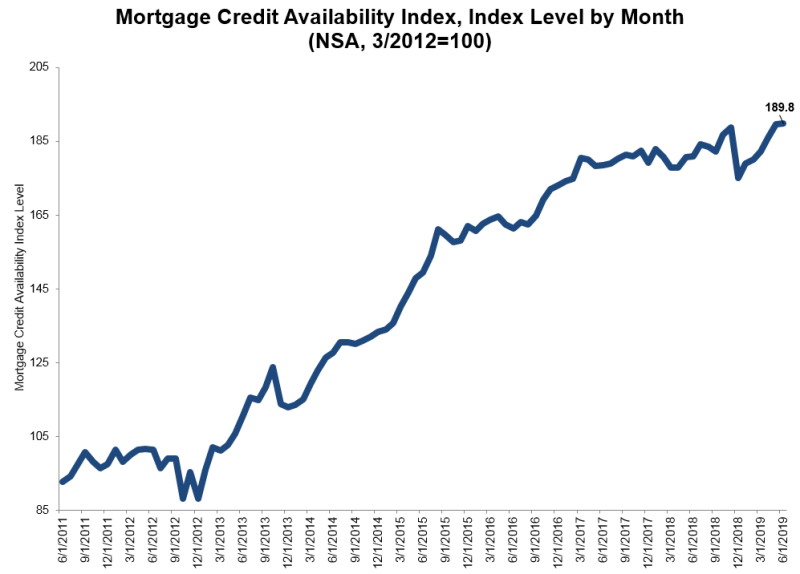

Mortgage Borrowers Fico Scores Rise To A 3 Year High Housingwire

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Which Credit Score Do Mortgage Lenders Use

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Fico Score The Score That Lenders Use

Which Credit Scores Do Mortgage Lenders Use Experian

Credit Score Needed To Get The Best Mortgage Rate Possible 800

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Credit Scores Used By Mortgage Lenders In Qualifying Borrowers

The Average Fico Credit Score For Approved Mortgage Loans

What Fico Score Do You Need To Get A Mortgage Credit Karma

Which Fico Score Do Mortgage Lenders Use Mortgage Credit Score Explained Youtube

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance